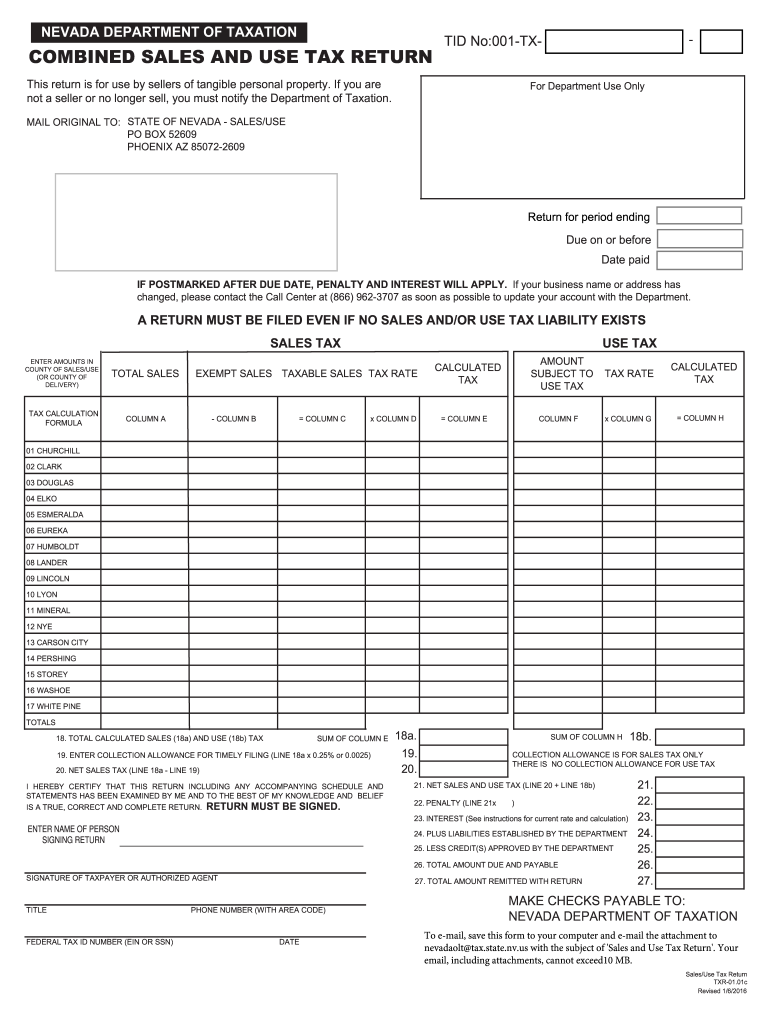

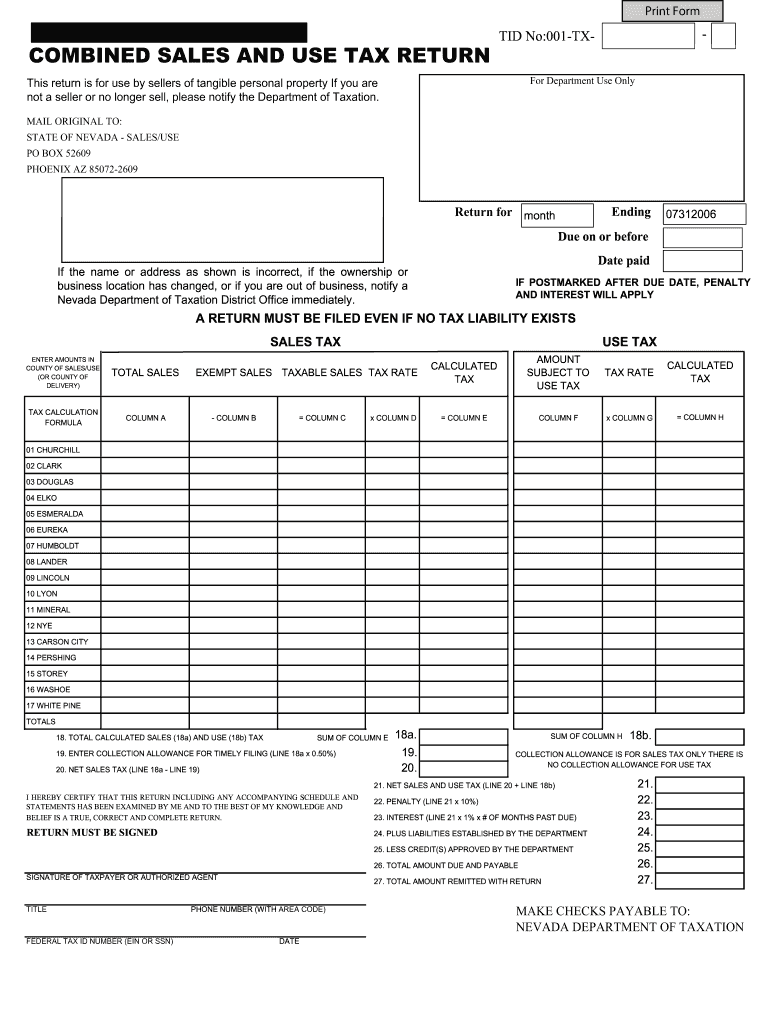

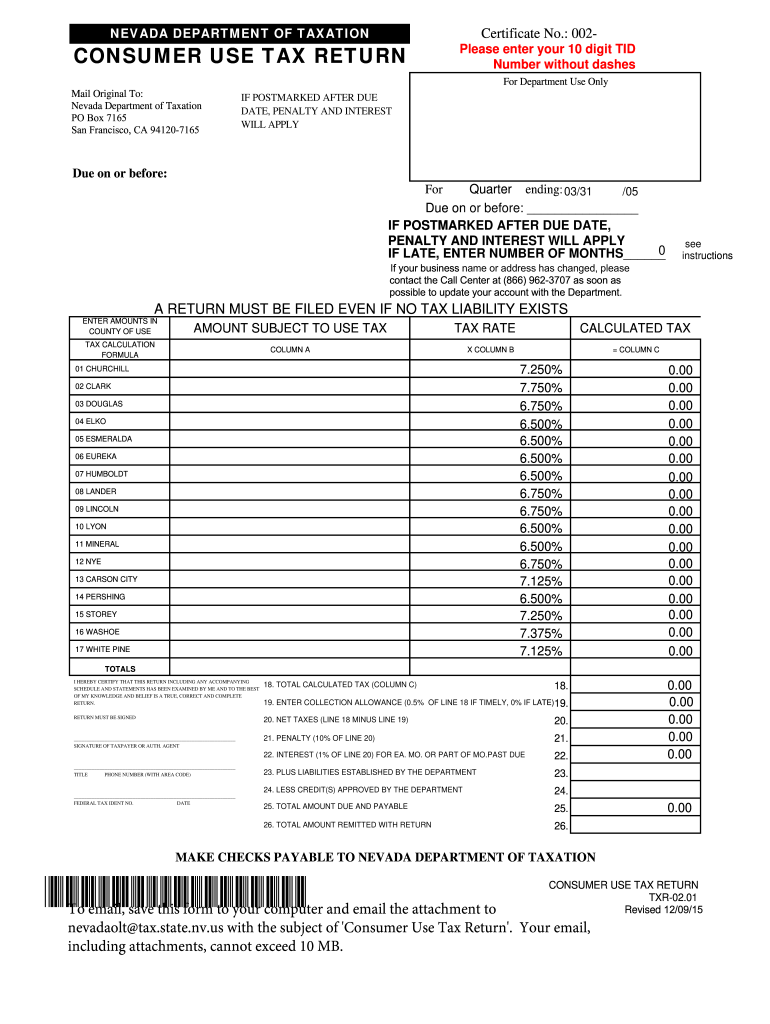

Sales Tax Nevada 2024. Local sales taxes are collected in 38 states. With local taxes, the total sales tax rate is between 6.850% and 8.375%.

Nevada sales and use tax Fill out & sign online DocHub, Nevada sales tax lookup :: Nv state sales tax rate.

Nevada sales tax rate 2022 Fill out & sign online DocHub, Nevada sales tax guide 2024 | lovat compliance. 6.850% local sales tax rate range.

Nevada Use Tax 20152024 Form Fill Out and Sign Printable PDF, The base level state sales tax rate in the state of nevada is 4.6%. 0.000% to 1.525% combined sales tax rate.

Nevada Sales Tax Guide for Businesses, 2024 guide to state sales tax in nevada. Published on december 14, 2023.

Nevada Sales Tax 2023 2024, The state sales tax rate in nevada is 6.850%. The actual rate at which you pay sales tax in nevada will vary as the.

Nevada 2023 Sales Tax Guide, Tax rates are provided by avalara and updated monthly. 4.6% is the smallest possible tax rate ( winchester, nevada) 6.85%, 7.1%, 7.6%, 7.725%, 8.265% are all the other possible sales tax rates of nevada.

Nevada Taxes Taxed Right, This is the total of state, county and city sales tax. You can use this simple nevada sales tax calculator to determine the sales tax owed, and total price including tax, by entering the applicable sales tax rate and the purchase price.

Sales Tax Nevada Rate, Sales tax in las vegas, nevada in 2024. Those costs are passed on to the buyer,.

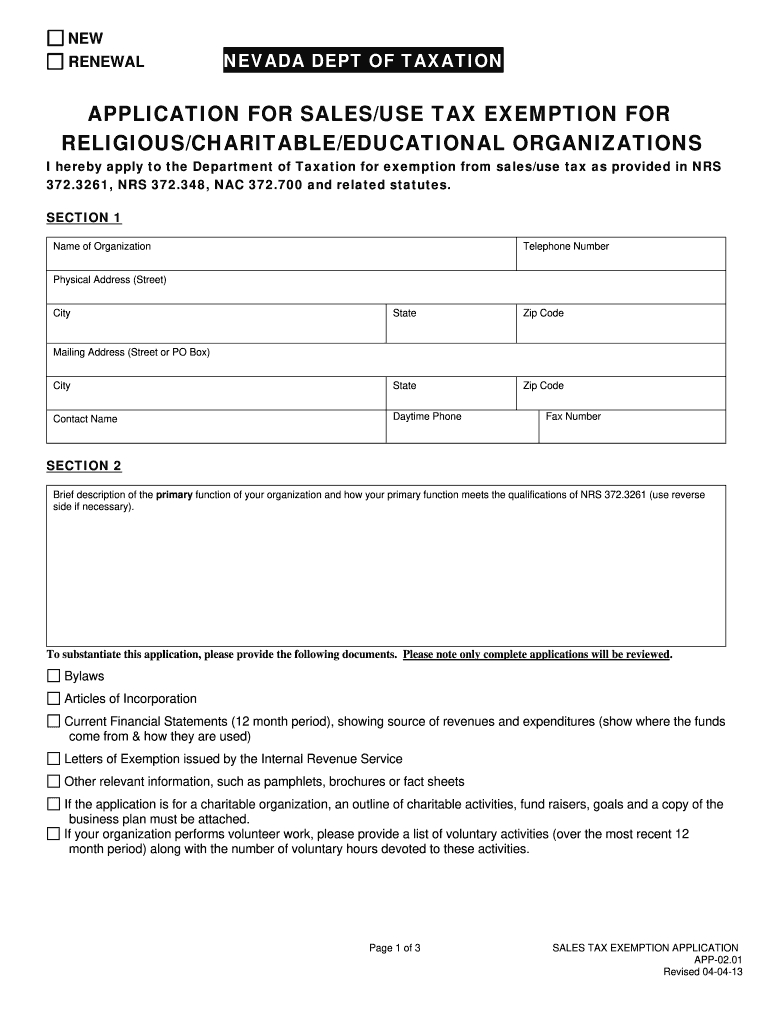

Nevada Sales Tax 20132024 Form Fill Out and Sign Printable PDF, 2024 guide to state sales tax in nevada. Sales tax is statutorily imposed on the sale, transfer, barter, licensing, lease, rental, use or other consumption of tangible personal property in nevada.

Sales Tax Nevada Form Literacy Basics, Nevada has recent rate changes (sat feb 01. Nevada sales tax range for 2024.